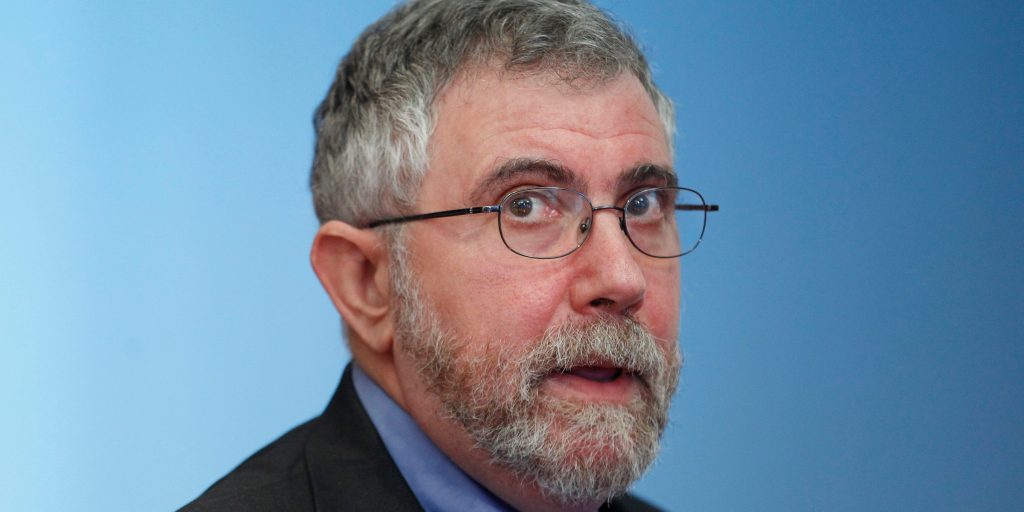

- Markets are flashing signs that they think the worst of inflation has passed, economist Paul Krugman wrote this week.

- He argues that this is more than just wishful thinking, and that there are two reasons that back this up.

- The Fed needs to not panic, as overtightening its policy risks forcing a "gratuitous" recession.

Markets took the June inflation report on the chin this week, but there are signs that they're betting the worst has passed — and there are two big reasons to back that theory up, according to economist Paul Krugman.

Many observers had already argued that inflation peaked in May, when CPI data clocked in at 8.6%. Now, however, markets are flashing signs that they actually believe that following the June report, which showed prices rising 9.1%.

In a New York Times op-ed, Krugman pointed to optimism evident in US government bond yields, specifically inflation protected securities, which are showing signs investors are expecting inflation to come down.

Krugman argues that markets are likely looking at a lot of data that hasn't come through in the official reports yet, such as figures on energy and housing costs, which both appear to be coming down. Moreover, things like high shipping costs and supply chain snags are also easing.

Apart from those factors, there are two clear reasons why investors should expect the inflation picture to improve in the near term and beyond.

First, wages have not "spiraled" the way many have feared they would. Wage inflation is among the stickiest kinds of inflation, but it isn't out of control in this case.

"[T]he rate of growth in average wages has actually been slowing, from around 6 percent at the beginning of this year to around 4 percent now. That's still somewhat too high to be consistent with the Fed's target of 2 percent inflation, but not by a lot," Krugman wrote.

Second, the economist argues that it is simply too soon to see the effects of the Fed's rate increases on inflation, and that nobody should have expected any impact in the three months since the central bank embarked on its rate hiking cycle.

"That is, if the Fed's change in policy is going to bring inflation down, that's all going to happen in the future. The markets think the Fed will contain inflation, and so do I; but June's consumer price report tells you nothing, one way or the other, about whether we're right. It's just too soon."

Fed officials on Thursday stated their support for another 75 bp rate hike at this month's meeting, soothing some fears of an even bigger increase that traders thought was likely after the June CPI figures were released.

"The biggest thing we currently have to fear is fear itself – that the Fed will let itself be bullied into hiking rates too much and produce a gratuitous recession," Krugman concluded.